Get Pre-Approved with NJ Lenders Corp, a Top-Rated Local Lender!

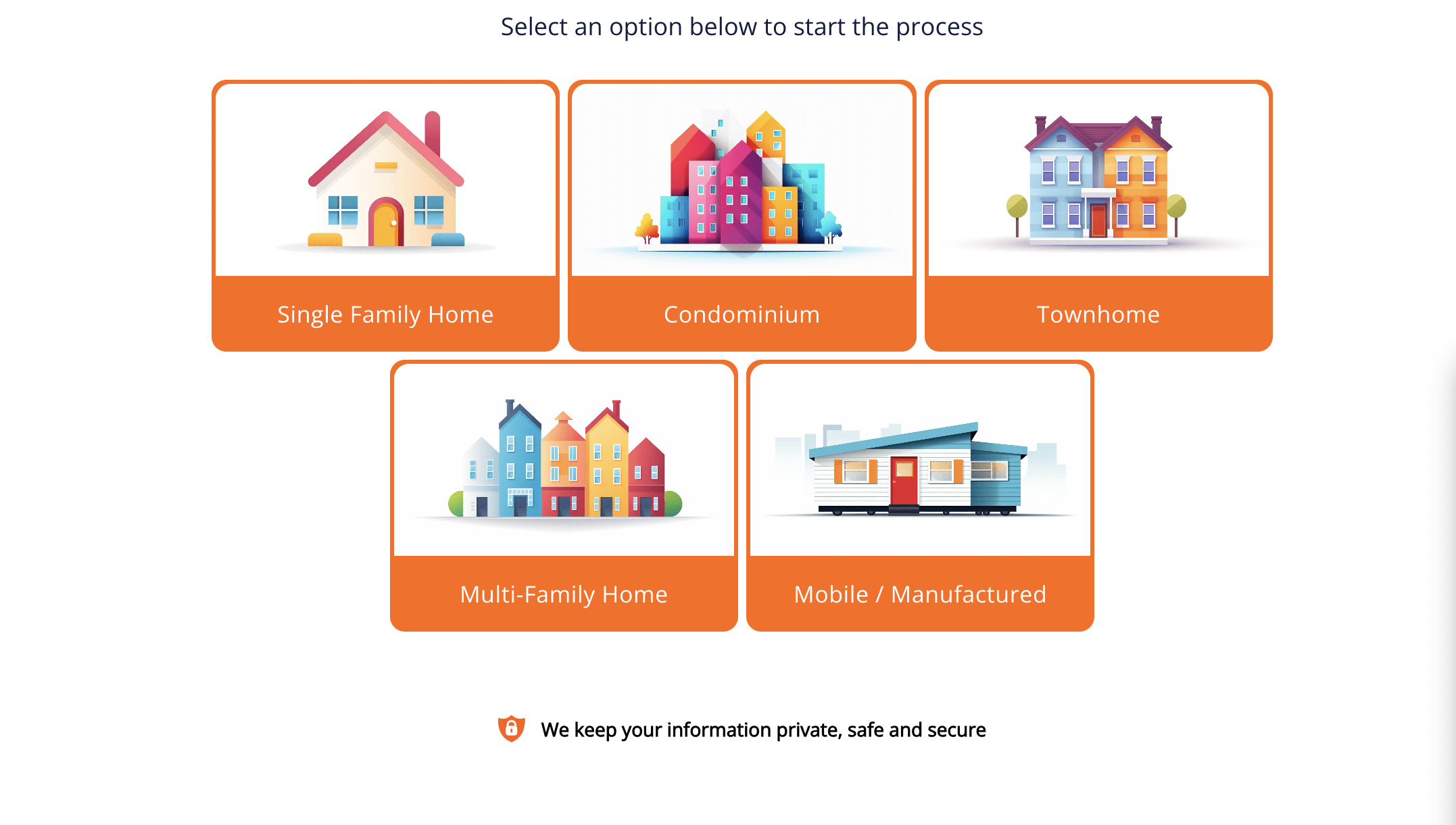

Know Your Budget Before You Shop – Get Pre-Approved for Your Mortgage Today

Currently, we are in a seller’s market. Inventory is low so buyers need to be as competitive as possible when securing the perfect home. Get a step ahead of other buyers by securing a mortgage pre-approval. Sellers want to choose someone that’s prepared and a mortgage pre-approval gives sellers confidence that closing the deal won’t get derailed by some unseen financial obstacle.

No login or SSN required. This will NOT affect your credit, and it takes less than 1 minute to complete!

TCPA disclaimer: By entering your contact information, you are providing express written consent for NJ Lenders Corp. NMLS: ID 35286 to contact you at the email and number you provided via telephone, mobile device, automated means like autodialing, text SMS/MMS and pre-recorded messages, even if you are registered on a corporate, state, or federal Do Not Call list. You are also acknowledging and agreeing to our terms of service and privacy policy. Consent is not required to use our services. Other restrictions and limitations may apply.

For Appointments: Eligibility subject to program stipulations, qualifying factors, applicable income and debt-to-income (DTI) restrictions, and property limits. Subject to individual program requirements and eligibility. Some restrictions may apply. Other programs available. This is an offer for a lender-paid consultation. There is no fee charged for the consultation. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change or termination without notice. All products are subject to credit and property approval.

Rates are not guaranteed and are subject to change without notice. Restrictions may apply. Annual Percentage Rate (APR), Loan-To-Value (LTV) and Debt-To-Income Ratio (DTI) information as of August 20, 2024. Loan-To-Value (LTV)

This is not a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet LTV requirements, and final credit approval.